Let’s Save TAX!

Taxes

|

Mar 1, 2021

Ladies! It’s that time of the year when you need to check if your tax savings are all in order. Here’s a way you can stash that cash (legally)! Umm…So what are our options?

Saving money isn’t taxing!

Feel like you’d like to stash away the green? Here’s your cheat sheet to maxing out those investments and keeping your taxes to the minimum.

Let’s talk Vitamin Sea! (Geddit?)

Section 80 C, of course!

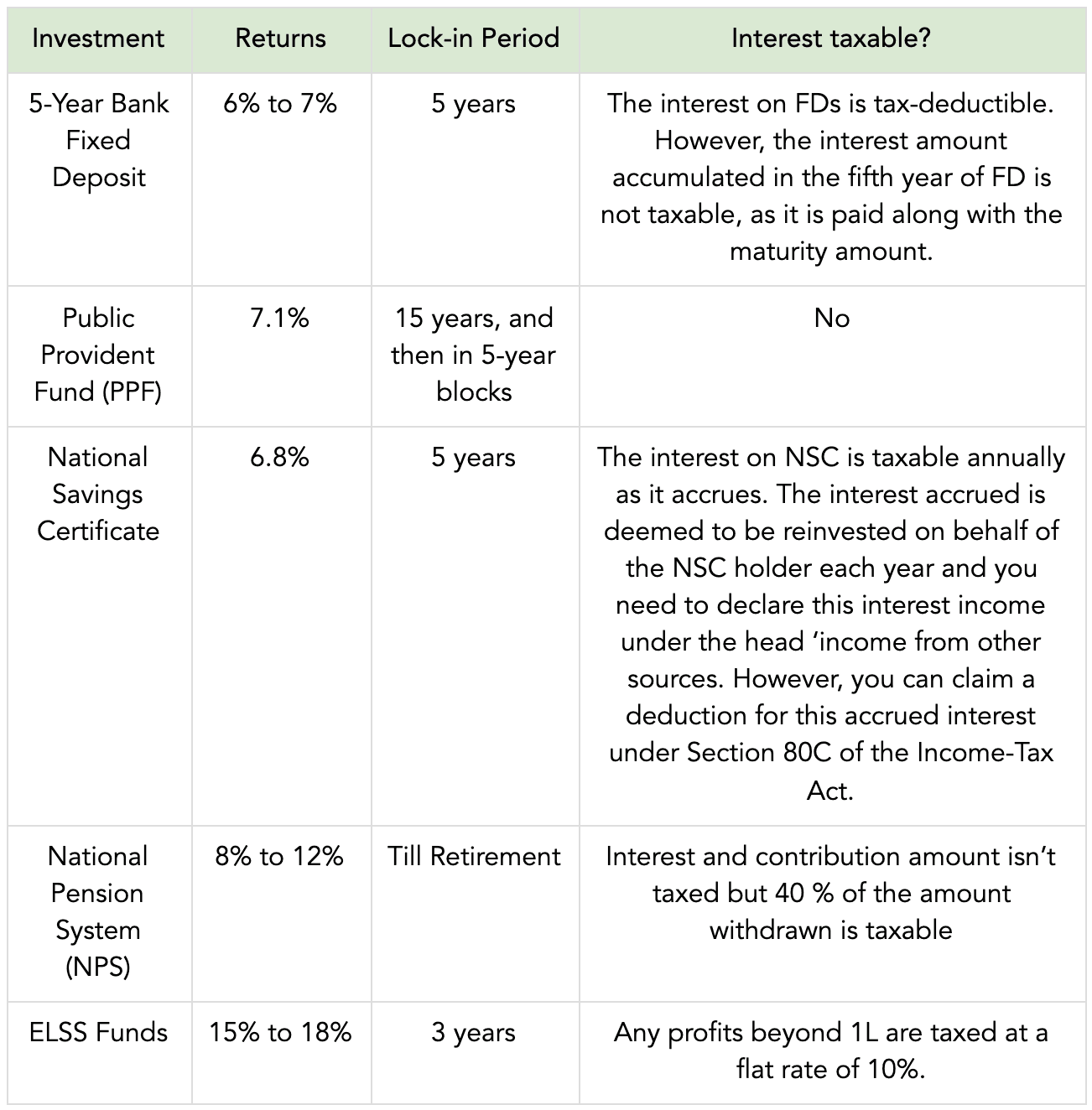

This is the most popular tax-saving section available to you as an individual taxpayer. Here, you can claim deductions up to the limit of ₹1.5 lakh in a financial year. The catch? There’s a lock-in period for these. Take a look at the most popular picks when it comes to tax-saving instruments.

Whispers in the corridors?

Many Tax experts are of the opinion that the Government is all set to increase the Section 80C limit from the existing ₹ 1.5 Lakh to ₹2.5 lakh in the Union Budget to be presented on February 1. Fingers crossed, here’s another reason to save more for the future!

Appetite to save more? Well, the grass is greener on both sides with deductions you can avail of in Section 80D.

- Get yourself Medical Insurance cover & claim an annual deduction of up to ₹ 25,000 (₹ 50,000 for in case you pay premiums for your parents who are Senior Citizens) for medical insurance premium

- What’s more? Claim deductions up to ₹ 50,000 on home loan interest under Section 80EE. A home loan would also help you in reducing your taxable income considerably.

Bottom Line

The season of savings has begun and it’s always better to plan these things out so that you don’t find yourself scrambling to make up the compulsory savings - and end up putting your money in an instrument that isn’t right for you

Add this into your yearly budget: When you chalk out your annual budget, allocate your tax-savings investments right then and there. April is the best time. This way, you won’t be running in circles to make these two meet. PS: Need help with the chalking out of the plan? Talk to an expert!

Make your investments in time: Save the date on this one as you will get the benefits only if you have made the savings in time. So forgetting someone’s birthday might not be cool, but forgetting the date for investments? That’s gonna cost you, literally!

*Information in this article is subject to change without prior notice. We would request you to check with the bank for the latest interest rates.

#taxes #tax #taxseason #accounting #business #incometax #smallbusiness #taxpreparer #entrepreneur #bookkeeping #taxrefund #money #finance #accountant #irs #taxpreparation #payroll #taxreturn #taxprofessional #covid #cpa #businessowner #businesstaxes #taxprep #taxtips #taxtime #refund #taxplanning #financialfreedom #bhfyp

Read More

Unleashing Alexis Rose's PR Magic: Building Her Own Empire

Mar 1, 2021

Unlocking your go to guide to navigate Gold 🌟

Mar 1, 2021

Investing in Gold 101 - A handbook on why, and how to invest in Gold

Mar 1, 2021

Is Taylor Swift REALLY saving the US Economy?

Mar 1, 2021

6 Lessons from The One-Page Financial Plan by Carl Richards

Mar 1, 2021

5 Reasons You Need a ̶P̶r̶e̶p̶a̶i̶d̶ Power Card

Mar 1, 2021