6 Lessons from The One-Page Financial Plan by Carl Richards

Investing

|

Jul 4, 2023

As the new month begins, and we embark on July, here's a quick refresher on lessons from one of our favourite reads: The One-Page Financial Plan by Carl Richards (Are we saying we recommend you to read it? A big yes). Whether you're looking to save, invest, or simply manage your finances better this month, read on:

Clarify your financial goals 🎯

The book emphasises the importance of viewing money as a tool to achieve your goals, rather than an end in itself. By identifying your financial aspirations and values, you can create a roadmap that aligns your money decisions with your life objectives. Example of a goal in your roadmap: I need to save 4L to make a trip to Bali by December, 2024.

Embrace simplicity and focus 🧘🏽♀️

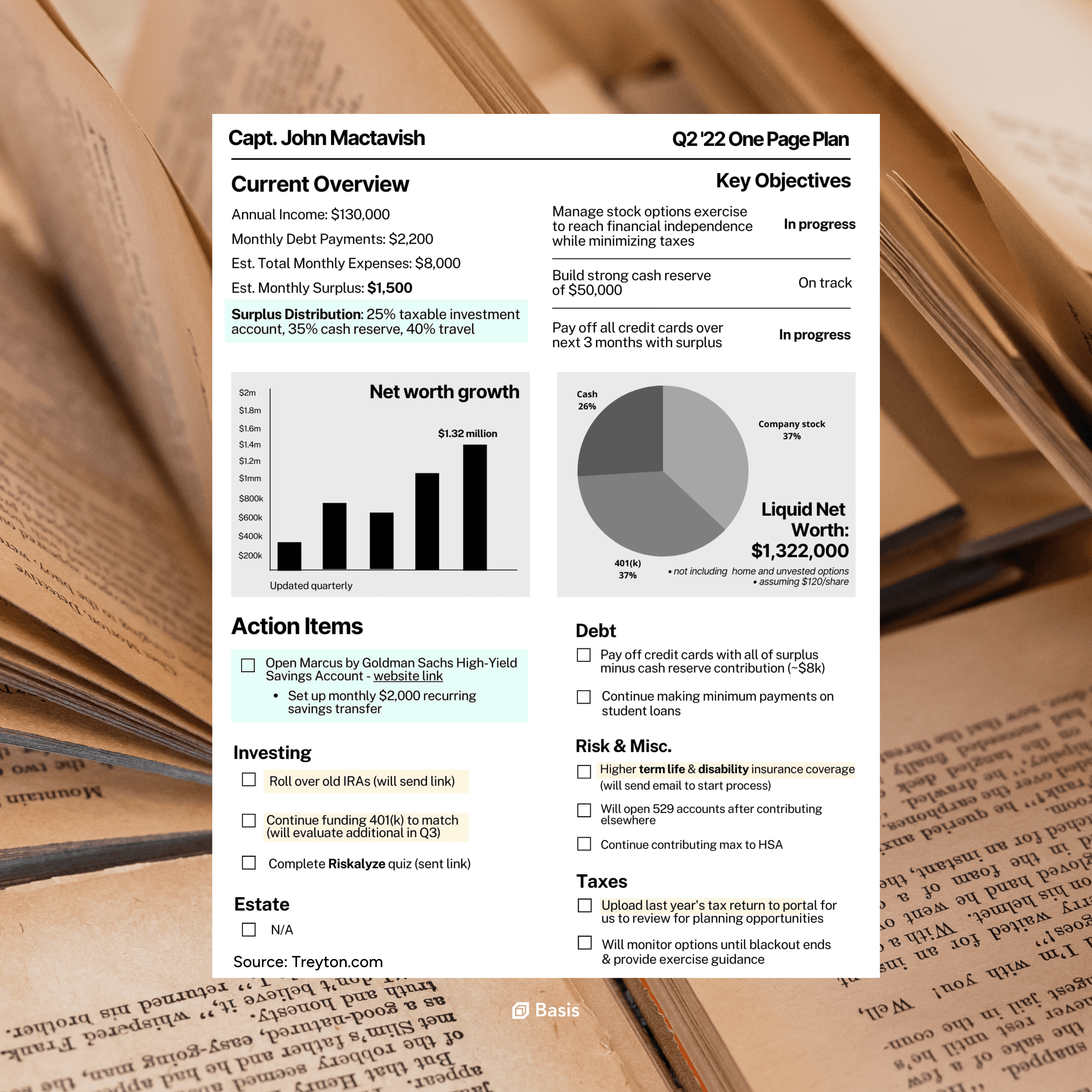

Richards advocates for simplicity when it comes to financial planning. He suggests creating a concise one-page financial plan that outlines your goals, investments, and strategies. By focusing on the essentials, you can avoid getting overwhelmed and make better decisions.

Here’s a quick template to help you visualise it:

Take control of your cash flow 💰

The book stresses the significance of managing your cash flow effectively. Understanding where your money comes from and where it goes allows you to allocate your resources wisely. By tracking your expenses and budgeting accordingly, you can optimise your financial situation.Mitigate risks through diversification 🌍

Richards emphasises the importance of diversifying your investments to manage risk effectively. He advises spreading your assets across various investment types and sectors to reduce the impact of market volatility and protect your wealth in the long term. Example: Different types of mutual funds, Gold, FDs.Be mindful of taxes 📊

The book highlights the impact of taxes on your financial journey. Richards encourages readers to consider tax-efficient investment strategies, such as utilising tax-advantaged accounts and making informed decisions that minimise tax liabilities. Where to start? Look at where you can claim tax deductions.Seek professional guidance 🤝

The author emphasises the value of seeking advice from financial professionals. A qualified advisor can help you navigate complex financial matters, provide personalised recommendations, and hold you accountable to your financial plan.

All in all, it’s a great book that provides readers with practical guidance on managing their finances while emphasizing the importance of aligning their money decisions with their life goals. By implementing these key lessons, you can take control of your financial future and make informed choices that support your aspirations.

Have questions? Well, you can always share them with the community on the Basis app, because we're all about that sass and knowledge! 💅

Read More

Unleashing Alexis Rose's PR Magic: Building Her Own Empire

Jul 4, 2023

Unlocking your go to guide to navigate Gold 🌟

Jul 4, 2023

Investing in Gold 101 - A handbook on why, and how to invest in Gold

Jul 4, 2023

Is Taylor Swift REALLY saving the US Economy?

Jul 4, 2023

5 Reasons You Need a ̶P̶r̶e̶p̶a̶i̶d̶ Power Card

Jul 4, 2023

Planning your retirement with Index Funds

Jul 4, 2023