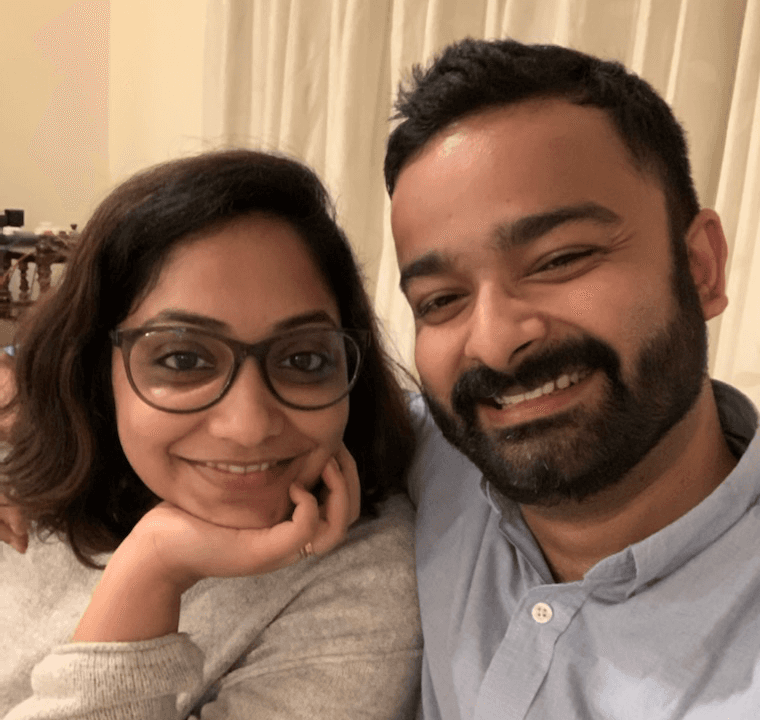

Basis Ally in Focus: Arvind - Why Women Need To Be Financially Independent.

Inspiration

|

Dec 7, 2020

“I moved to South Africa when I was 13, my dad is a CA and when it came to choosing a subject for higher studies, I chose commerce over science. When I went to do my masters in the UK, I realised how expensive it was, and I was acutely aware of my financial situation and managed my money. Living alone, inculcated the need to save.”

“It is something people should think about earlier in their life. It’s strange that money is so gender-biased and these things need to change. Financial Independence is so empowering and that’s why my wife and I have our own investment accounts.”

“Growing up my dad, between my parents managed all the finances, my mother didn’t really show much interest in finance. That’s a part of the problem. My mother was the first person who told me about financial empowerment, when she passed the age of 50 she was running a small business of her own, and earning her own money that she could make decisions on.”

“My aunt and my mom are huge influences in my life; they both run this business, aunty-preneurs.com. Financial empowerment is a deep-rooted problem and it takes time for women to start their own business. My mum’s life could have looked very different.”

“ I first came across Basis when the women of WeWork wanted financial independence conversations, I knew people in wealth management and my financial advisor referred Basis to me. I went through the app and this was something that instantaneously seemed interesting.”

“Basis hits the problem of financial empowerment squarely, it is a platform that is not imposing anything to the user. It serves the education problem very directly and helps women learn at their own pace. The positioning of it being a women-first problem, it reveals the problem in a very interesting way and gets more women to think about it, which is a start to actual gender equality.”

Arvind today, is a strong Basis brand advocate.

Read More

Unleashing Alexis Rose's PR Magic: Building Her Own Empire

Dec 7, 2020

Unlocking your go to guide to navigate Gold 🌟

Dec 7, 2020

Investing in Gold 101 - A handbook on why, and how to invest in Gold

Dec 7, 2020

Is Taylor Swift REALLY saving the US Economy?

Dec 7, 2020

6 Lessons from The One-Page Financial Plan by Carl Richards

Dec 7, 2020

5 Reasons You Need a ̶P̶r̶e̶p̶a̶i̶d̶ Power Card

Dec 7, 2020